In March CFO South Africa's principal sponsor KPMG brought a team of its most eminent tax experts from all corners of Africa to Johannesburg to speak to a gathering of CFOs during the Moving into Africa event in the Michelangelo Hotel in Sandton.

Read a great article about this event.

After a general introduction by Devon Duffield, Chairman: Tax & Legal at KPMG, one of the most impressive speakers was Victor Onyenkpa, Partner and Head of Tax Regulatory and People Services at KPMG in Nigeria. He focuses on the English-speaking countries in West Africa: Nigeria, Ghana and Sierra Leone. Here are 5 things CFOs should know about tax in West Africa.

- Except in mining and in the oil & gas industry, the (revenue) authorities in Nigeria, Ghana and Sierra Leone have no problem with 100 percent foreign ownership of companies. "You can come to West Africa, set up shop and own that shop," says KPMG's Victor Onyenkpa. "And there is no restriction on profit repatriation."

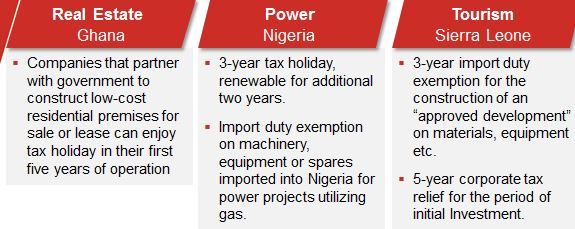

- West African countries have reasonable corporate tax rates (around 30%) and tax holidays for selected sectors, like low cost housing (Ghana), tourism (Sierra Leone) and power production (Nigeria).

- Onyenkpa: "The biggest area of discomfort is section 19 of the Companies Incomes Tax Act in Nigeria. It says that dividend paid where a company records no total profits or total profits less than dividend paid, shall be charged to tax as if the dividend is the total profits of the company. It is a peculiar provision. Unfortunately a recent ruling upholds tax based on dividends, whether or not such profits have already suffered tax."

- KPMG expects the introduction of regulation around transfer pricing and an aggressive tax revenue drive in the near future. "Oil provides revenue for government. With the oil price dropping these are interesting times," says Onyenkpa.

Tax authorities are open to engagement and there is a dispute resolution process in the event of disagreement. "Revenue authorities are very easy to access these days and even a country like Nigeria is starting to adopt global standards. The authorities listen to feedback and in Ghana, for example, they are also taking note of the input we give for future tax laws," says Onyenkpa.

Tax authorities are open to engagement and there is a dispute resolution process in the event of disagreement. "Revenue authorities are very easy to access these days and even a country like Nigeria is starting to adopt global standards. The authorities listen to feedback and in Ghana, for example, they are also taking note of the input we give for future tax laws," says Onyenkpa.

- Stay connected, up to date and in the loop on what is happening in the world of finance and keep track of newly published expert insights and interviews with CFOs and CEOs. Become an online member and receive our newsletter, follow us on Twitter and join us on LinkedIn.