In the majority of organisations, planning, budgeting and forecasting (PBF) processes are flawed. KMPG’s Charl du Toit suggests that a fully integrated planning process is essential to deliver full benefit and value from the planning process – and help your organisation achieve its goals.

Also read:

- CFOs now need to look beyond survival: Alwyn van der Lith, KPMG partner

- International investors are eyeing African healthcare: Anuschka Coovadia, head of Healthcare Africa for KPMG.

- CFOs should know PE firms want asset growth in Africa: Michael Rudnicki, head of Southern African PE practice, KPMG.

- Power and agri biggest opportunities: Jason Kazilimani, CEO KPMG Zambia.

- Diplomatically discuss inconvenient truths in public sector: Edson Magondo, KPMG

A common theme KPMG is seeing in its client base is that the planning function is placed under stress from a variety of sources. These include internal pressures, such as organisational complexity, skills shortages, disparate systems and governance issues, as well as external pressures, such as market forces and expectations, geographic requirements, and disruptive technologies.

In the face of these challenges, current PBF processes are characterised by a large investment in sub-optimal processes which do not meet the strategic or operational needs of the business. Instead, they should be investing in fully integrated planning processes, like Integrated Business Planning (IBP).

Some of the key challenges for organisations are:

- Inconsistent planning processes - different approaches to planning across the organisation mean different understandings of key measures, and inconsistent methods lead to disconnected plans.

- Planning and forecast accuracy - the budgets and forecasts delivered were not particularly accurate, which causes concern both internally and externally.

- Integration of actuals and plans - some organisations struggle to integrate the plans with the actual data, because they don't have a single planning platform, and do have a number of disparate source systems. This makes it difficult to accurately report on performance against plan.

Companies are starting to implement certain measures in the PBF processes in order to address these typical issues. Some of the key trends are:

- Process standardisation - companies are standardising their planning approach across the entire organisation to ensure consistency in method and interpretation of results, and to ensure all areas use the same definitions of key metrics.

- Reduction of planning content - organisations are planning on less line items, focusing on the key items which have the most impact on results. This goes hand in hand with using value-based driver models, which lessens the amount of input required and calculates more detailed plans based on the well-defined drivers.

- Less budget and more forecast - organisations are moving away from a once-a-year budget process and implementing monthly or quarterly rolling forecasts, which are more dynamic and provide more timely feedback on performance.

- Use of a standard technology platform - organisations are implementing standard planning technology platforms, and moving away from Excel and siloed planning systems. This helps ensure consistency in approach, definitions, and the use of reliable planning methods.

KPMG has analysed some of the global organisations recognised as leaders when it comes to their PBF processes. Some of the behaviours which were common across these organisations include the following:

KPMG has analysed some of the global organisations recognised as leaders when it comes to their PBF processes. Some of the behaviours which were common across these organisations include the following:

- Rolling forecasts - every single one of the leading practices made use of rolling forecasts, usually on a monthly basis. This means they have a completely up to date view of how performance is tracking and are able to adjust targets and expectations more frequently in response to changing environments.

- Value-driven budget models - the leading practices defined budget models based on the key measures which drive performance and the model calculates the more detailed items automatically.

- Align budget to KPIs - planning is done on key indicators linked to strategy, not purely on the financial account structure. This ensures the plan can be used to measure achievement of strategy.

- High level of accuracy versus good enough - the leading practices insist on having forecasts and budgets of a high level of accuracy and do not accept 'good enough' plans.

- Variance analysis aligned with business imperatives - Variance analysis is not just an automatic actual versus plan report for every single line item, but rather focused on measuring the variance of key indicators, as dictated by the business imperatives relevant at that specific point in time.

- Collaborative target setting - targets are set through a collaborative process which ensures there is buy-in and ownership of targets, and not something forced down from above.

- Fully integrated ERP and EPM environments - there is full integration between the ERP and planning systems, making it possible to import actual data for proper analysis of performance, and to use this to adjust forecasts using the latest available data.

- Fully trained, empowered employees - leading practices ensure the employees involved with the planning process are firstly fully trained to use the available technology and secondly, are empowered to take ownership of their plans.

- Use enabling technologies - leading practices all make use of some kind of common, central planning platform, and not disparate, Excel-based processes. This drives consistency in approach and definition of measures and methods.

Integrated business planning

In order to address these challenges in the PBF process, and to assist organisations to move towards becoming leading PBF practices, KPMG suggests that companies implement an integrated business planning (IBP) approach. IBP aligns strategic planning, financial planning and other operational planning activities such as supply chain, sales, marketing and product development planning into a unified planning operating model in order to make proactive business trade-offs and improvement decisions.

IBP creates value by realising three specific objectives to support improved financial performance:

- Integrating planning activities - IBP aims to integrate all the different levels of planning activities, i.e. strategy, finance, sales, product and operations planning, into a single model, to drive common approaches and make it easy to share data between different activities to ensure consistent results.

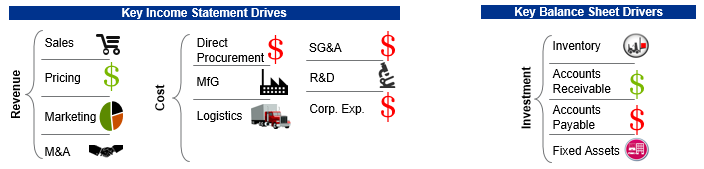

- Understanding key business drivers - For an integrated model to work across all levels it is vital to have a shared understanding of key business drivers. It is a truism in the PBF field that the more important a measure is to the organisation, the more different definitions there are of what it actually means. Only through a common understanding of these key drivers can an integrated planning model be realised.

- Improving business decisions - Due to the alignment of planning processes, having a common platform, understanding measures and results, being able to know results sooner and being able to perform better analysis, implementing IBP correctly will drive better business decisions.

In short, IBP connects strategy with execution and intent with outcome, and makes it possible to accurately and quickly measure this. IBP harmonises financial and operational processes with customer demand, enables organisations to optimally collaborate and address cross-functional business decisions, and delivers alignment of planning and execution processes to improve predictability and financial performance. A key aspect of IBP is that it impacts all aspects of financial statements, not just providing a sales or expenses plan.

IBP leading capabilities

In order to effectively implement IBP, the KPMG IBP operational model provides guidance to the leading capabilities required. These capabilities, if developed correctly, will help ensure your organisation can implement a proper IBP model, which covers all the required bases.

These capabilities are organised according to the key objectives for IBP as outlined above.

How to approach implementing IBP at your organisation

It might seem like a huge task to implement IBP at your organisation. Taking a sub-optimal planning process, which might suffer from most if not all of the issues discussed earlier, and changing that into an IBP model which delivers on the promised benefits might seem like too much to take on. However, at KPMG we can assist and we have an approach which has proven effective to do exactly this.

Like all large transformations, we do not suggest you do all at once, but rather take a step-by-step approach. Our suggested approach covers the following areas:

- Develop your current PBF state hypotheses: Analyse your current PBF processes and determine the current state. At KPMG we have industry benchmark databases which are used to benchmark your planning function against your peers, which helps identify problem areas.

- Prioritise key IBP gaps and opportunities: Firstly, do a maturity assessment of your existing planning environment. This is done by plotting the planning maturity against 12 key dimensions which helps sketch a picture of how mature your processes are across various key elements. After this key, gaps are identified and prioritised based on the business impact and level of effort for each of these.

- Develop a planning transformation roadmap: The desired future state for planning is developed using the IBP framework, as well as guiding principles relevant to the organisation such as required timing, accuracy targets, etcetera. A governance and role matrix is developed to align key stakeholders and ensure everyone required is involved.

- Execute on key initiatives and embark on the transformation journey: Based on the roadmap, execute quick wins, measure the success of these, and maintain momentum by continually adding to and improving the IBP environment.

Why South Africa lags behind

In South Africa, the PBF processes lag far behind other developed countries. It takes South African companies eight to 12 weeks to complete a budgeting cycle. It takes European and North American countries companies an average of four weeks to do the same.

One of the reasons for this much longer budget cycle time is that South African companies underuse rolling forecasts. A survey by Oracle found that 84% of South African companies do not do any form of rolling forecasts and, even worse, 74% of South African companies do no forecasting at all. Effective forecasting means the forecast can inform the budget and lessen budget cycle time, and if done correctly a rolling forecast can supplant a budget completely, where a version of the forecast becomes the budget.

If this is used in conjunction with a standardised budgeting platform (61% of South African companies do their budgets on Excel), combined with a true integrated business planning approach to planning, South African companies have huge opportunity to improve and gain true value from the planning process.

- Stay connected, up to date and in the loop on what is happening in the world of finance and keep track of newly published expert insights and interviews with CFOs and CEOs. Become an online member and receive our newsletter, follow us on Twitter, like us on Facebook and join us on LinkedIn.