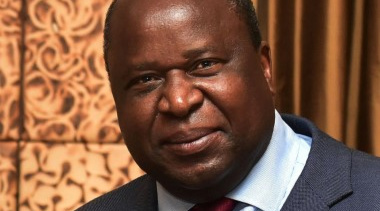

Finance Minister Tito Mboweni announced spending cuts to offset falling tax revenue in his MTBPS.

On 28 October, in his medium-term budget policy statement, Finance Minister Tito Mboweni revealed National Treasury's plans to freeze public sector wages for the next three years, to help cut its salary bill. This is one of several measures to contain a growing budget deficit.

The economy was already in recession before the Covid-19 pandemic struck in March, so restrictions on people and business aggravated already dire socio-economic woes.

The consolidated budget deficit is projected at 15.7 percent of gross domestic product (GDP) for the fiscal year 2020/21 ending next March, more than double last fiscal year’s 6.4 percent shortfall, and the widest gap in the post-apartheid era.

The economy has contracted 7.8 percent in 2020, while public debt has ballooned to more than three quarters of GDP.

South Africa has 1.3 million public sector employees, whose collective wages now make up 11 percent of GDP, up from nine percent in 2004/05. The National Treasury is seeking nearly R311 billion ($19 billion) in wage bill reductions by 2023/24.

The wage-freeze plan is likely to cause disagreement with labour unions, given that unions affiliated to the trade union federation Cosatu have already taken the government to court to challenge its failure to honour the pay increases for the last year of the 2018 three-year wage deal.

Treasury said the government was working to formulate its position on pay ahead of the next round of wage negotiations.

More than 80 percent of the total compensation reductions will be made in the education, health and peace and security sectors, Treasury said. It is pinning its economic recovery hopes on more spending on infrastructure investment.

Gerhard Kotzé, MD of the RealNet estate agency group, says that while the real estate sector is currently performing very well in spite of the major contraction in the economy this year, it will be difficult to sustain this momentum without the consumer and business confidence that comes from a growing economy in which new jobs are being created.

“In addition, it was good to hear that the applications that will allow cities such as Cape Town and Johannesburg to provide their own power are being fast tracked – and that almost 12MW of additional power from Independent Power Producers will be available soon. This will hopefully mean that loadshedding becomes a thing of the past.”

However, he says some serious concerns remained unanswered, the first of these being what new taxes or tax increases South Africans can expect in the light of the huge increase in the Budget deficit. It does not seem likely that this revenue shortfall can be recovered solely by cutting public spending, especially since there is such resistance to cutting the public sector wage bill.

Palesa Mabasa, FNB Gauteng south west segment head, says the statement highlights the need for fiscal rehabilitation to rebuild, rehabilitate and recover.

Palesa asserts that the short-term focus on building infrastructure, expanding electricity generation, allocating digital spectrum and supporting rapid industrialisation could mean increased opportunities for SMEs who are players in the infrastructure value chain. It could also mean improved electricity supply, leading to fewer interruptions due to load shedding/load reduction and cheaper data costs assisting ecommerce and running overheads to decrease.

Palesa expects that in the long term, the R12.6 billion that has been allocated to fund employment initiatives will lead to increased economic stimulus and GDP growth. “SMEs must ensure they are positioned to take advantage of this by ensuring all compliance and procurement requirements are up to date and correct,” she says

The MTBPS’s main features include:

- Treasury expects to raise a net R143 billion in domestic short-term loans in the fiscal year through March, and an average of R66,7 billion annually over the next three years.

- It intends raising R462,5 billion in domestic long-term loans this year, and an annual average of R469,9 billion over the following three years.

- Foreign loans totalling R121,8 billion are set to be raised this year, R49.4 billion in 2021-22 and R49,3 billion in the year after that.

- Gross loan debt is expected to rise to R5,54 trillion, or 92.9 percent of gross domestic product, in 2023-24, from R3,97 trillion, or 81.8 percent, this fiscal year.

- Debt-service costs are projected to increase to R353,1 billion in 2023-24, from R233 billion.

Read more: Five key takeaways for business from the 2020 mid-term budget presentation