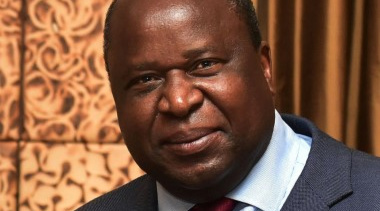

Tito Mboweni’s 2021 budget speech was largely well received. Here’s what you need to know.

Tito Mboweni’s budget speech, delivered on 23 February, focused on fiscal consolidation and reducing the government wage bill by R300 billion in the next three years. He anticipated that the budget would grow by 3.3 percent this year after a decline of 7.2 percent last year, boosted by a budget deficit decrease from 15 percent to 6.3 percent.

These are some of the key takeaways for business:

Decrease in the corporate tax rate and no increase in income tax

The budget made clear that the government is aware that they cannot increase revenues through ongoing tax hikes. “An increase in tax rates will, in the current overtaxed South African environment, ultimately lead to decreased tax revenues over the medium to long term. It is for this reason that Government has proposed a cut in the corporate income tax rate from 28 percent to 27 percent, effective April 2022, coupled with the making provision for so-called ‘fiscal creep’ not to have an effect on taxpayers this year by allowing for tax brackets to be raised by five percent across the board.”

While the corporate tax decrease will no doubt be welcomed, this does come with the termination of ineffective incentives.

“It appears that any roll out of any specific business incentives has been sacrificed for the overall decrease of one percent in the corporate tax rate. This is however in line with the trend of terminating ineffective incentives or incentives that have seemingly been abused,” says Tapie Marlie, PwC tax director.

Fuel levies increase

The fuel levies increase by 27 cents a litre is a blow to individuals and business alike. The Automobile Association (AA) expressed disappointment with the fuel levy increase. “It will hit motorists’ pockets, especially if the fuel price continues rising as has been the trend in the past four months.”

The rand responds

The markets responded relatively well to Mboweni’s budget speech.

“Tito Mboweni's budget appears to have been relatively well-received by markets with the Rand initially firming to 14.4000 levels post the speech. The Rand had a bit of a rollercoaster ride thereafter, spiking up to 14.6500 before closing stronger at 14.4887 as the Dollar slipped further against the majors,” says Andre Cilliers, currency strategist at TreasuryONE. “The local currency is currently [on Thursday morning] trading unchanged at 14.4925 in the far East. The main positive takes from the budget are improved revenue receipts, debt stabilization, improved growth outlook, and expenditure control. Time will tell whether this will play out as planned.”